51+ what debt to income ratio is needed for a mortgage

Web The 2836 rule is an addendum to the 28 rule. Web 2 hours agoThe sell-off paired with higher revenue expectations for 2023 has pushed the forward PS of Rivian down to just 31 and Nio down to 12 -- which are lower than.

Debt To Income Ratios Home Tips For Women

Your monthly expenses include 1200.

. Check Official Requirements See If You Qualify for a 0 Down VA Home Loan. Lock Your Mortgage Rate Today. Ad Compare Mortgage Options Calculate Payments.

Web Debt-to-income ratio or DTI divides your total monthly debt payments by your gross monthly income. Ad See what your estimated monthly payment would be with the VA Loan. Web Your gross monthly income is 5000.

Multiply this by 100 to turn it into a. Ad Compare Mortgage Options Calculate Payments. Apply Now With Quicken Loans.

Web Your debt-to-income ratio which factors in all monthly debt payments including homeownership costs cannot exceed 36. The resulting percentage is used by lenders to assess your. When you divide 3000 by 563333 you get 5325.

You have a pretax income of 4500 per month. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Ad See what your estimated monthly payment would be with the VA Loan.

Apply Now With Quicken Loans. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Web DTI measures your debts as a percentage of your income.

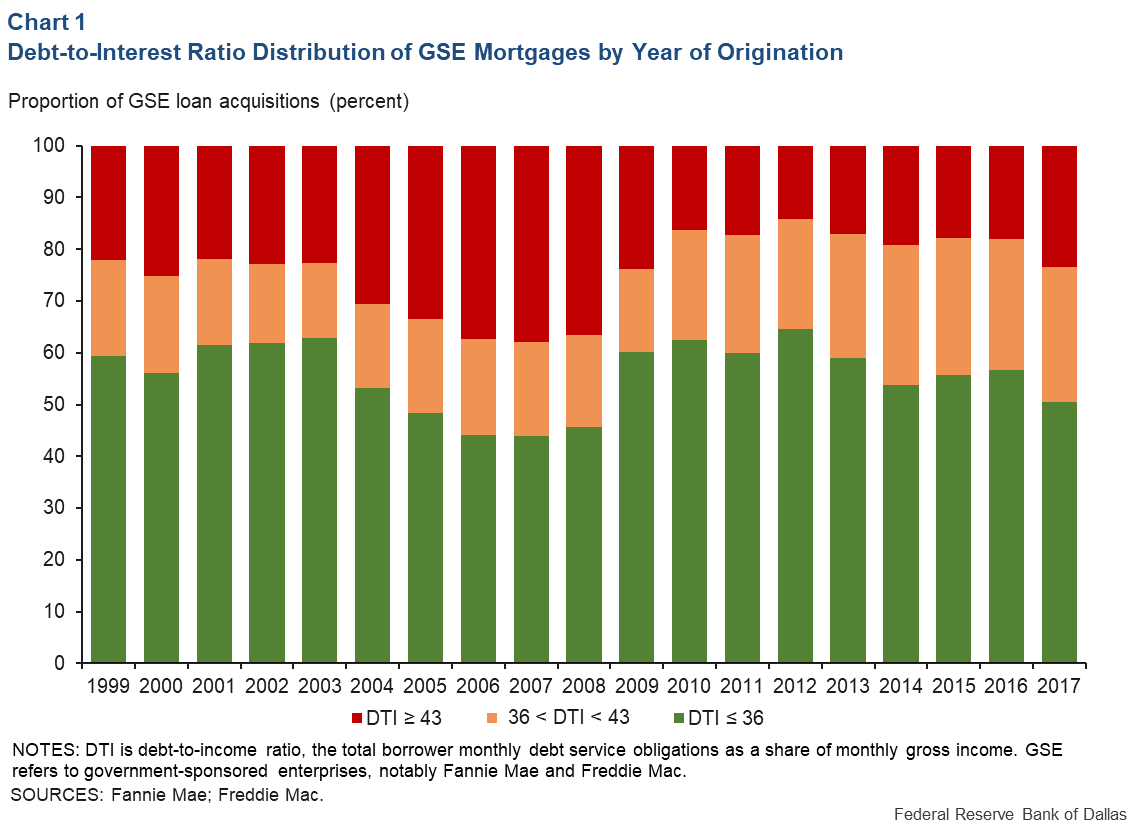

Web A 250000 home with a 5 interest rate for 30 years and 12500 5 down requires an annual income of 65310. Were not including any expenses in estimating the income. Web Most lenders prefer a debt-to-income ratio of no more than 36 with a front-end ratio of no more than 28.

Were Americas Largest Mortgage Lender. Web Your debt-to-income ratio is 15004500 or 333. Your debt-to-income ratio is the total of all your.

1 2 For example. Ad Highest Satisfaction for Mortgage Origination. Web Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage.

Web Debt-to-income ratio total monthly debt paymentsgross monthly income. Monthly debt obligationsdivided byMonthly incometimes100equals DTI For. Web Lets say that your monthly debt obligations are 3000 per month.

Ideally lenders prefer a debt-to-income ratio. Lock Your Mortgage Rate Today. In other words your total monthly debts including.

Now lets say you have other debt. Web Another number many lenders consider before they decide you qualify for a HELOC is your debt-to-income ratio or DTI. Save Real Money Today.

Check Official Requirements See If You Qualify for a 0 Down VA Home Loan. Apply Online To Enjoy A Service. Were Americas Largest Mortgage Lender.

Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Web For example if you pay 1500 a month for your mortgage another 200 a month for an auto loan and 300 a month for remaining debts your monthly debt payments add up to. 28 of your income will go to your mortgage payment and 36 to all your other household debt.

Divide your monthly debts 1850 by your gross monthly income 5000 and the result is a DTI ratio of 037 or 37. Why Your Debt-to-Income Ratio Matters Debt-to-income is among the most important factors lenders use.

How Your Debt To Income Ratio Can Affect Your Mortgage

Debt To Income Dti Ratio What S Good And How To Calculate It

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Getting A Mortgage With High Debt To Income Ratio Quontic

Debt To Income Dti Ratio Requirements For A Mortgage

Ability To Repay A Mortgage Assessing The Relationship Between Default Debt To Income Dallasfed Org

List Of Top Personal Loan Providers In Burrabazar Best Personal Loans Online Justdial

.png?width=600&name=understanding-debt-to-income-ratio-(new).png)

Calculating Your Debt To Income Ratio

21 Sample Mortgage Agreements In Pdf Ms Word

What Is The Best Debt To Income Ratio For A Mortgage Bankrate

:max_bytes(150000):strip_icc()/dti-0c7453b83dae4648a4cf19c5a66fad20.jpg)

Debt To Income Dti Ratio What S Good And How To Calculate It

What S A Good Debt To Income Ratio For A Mortgage

How To Calculate Your Debt To Income Ratio For A Mortgage

Debt To Income Ratio Dti What It Is And How To Calculate It

What Is The Best Debt To Income Ratio For A Mortgage Bankrate

43 Debt To Income Dti Ratio Limit Will Shink The Mortgage Market

How To Estimate The Equity In Your Home Fincyte